The Canton Network: Infrastructure for Institutional-Grade On-Chain Finance

In an era where financial markets demand both programmability and regulation-grade privacy, the Canton Network is emerging as a cornerstone infrastructure for tokenisation of RWA, DeFi and privacy.

Oct 20, 2025

In the world of digital assets, one of the greatest challenges has been how to bridge the innovation of blockchain with the structure and trust required by institutional finance. The Canton Network is setting out to do exactly that; by creating a privacy-preserving, interoperable, and scalable blockchain ecosystem designed for real-world asset tokenisation and on-chain financial markets.

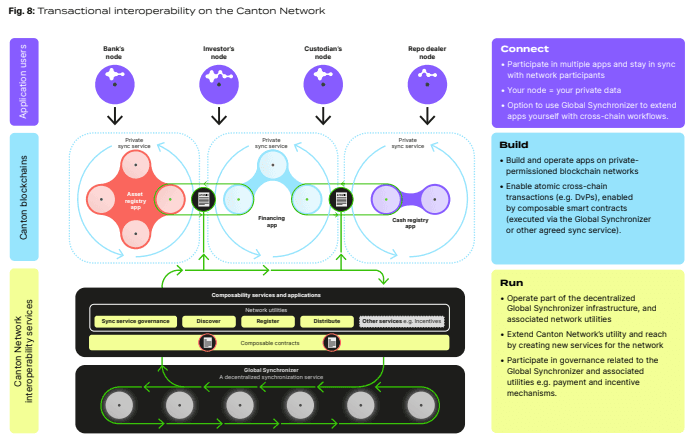

Unlike most blockchains that rely on a single, global ledger, the Canton Network is built as a “network of networks.” It allows multiple independent sub-networks called sync domains to operate in parallel while still being able to interconnect and transact atomically when needed. Each domain can have its own governance, permissions, and privacy policies, making it possible to tailor the network to the specific regulatory or operational needs of an institution. At the same time, the entire ecosystem remains interoperable, thanks to a shared public infrastructure called the Global Synchronizer, which ensures atomic settlement and consistency across domains.

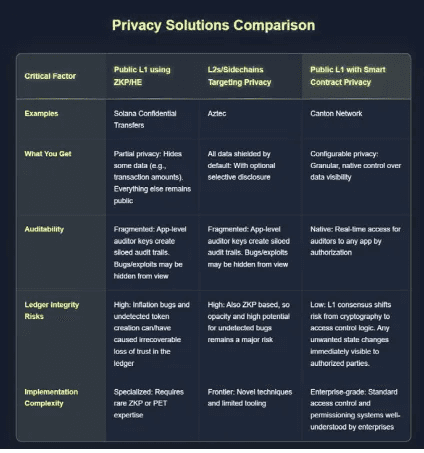

This design marks a major departure from traditional public blockchains, which require every participant to share a common global state and visibility into all transactions. Canton’s architecture is instead designed for confidentiality and control, without sacrificing composability or decentralisation.

How the Network Works : Technical Architecture

Sub-networks and the Global Synchronizer

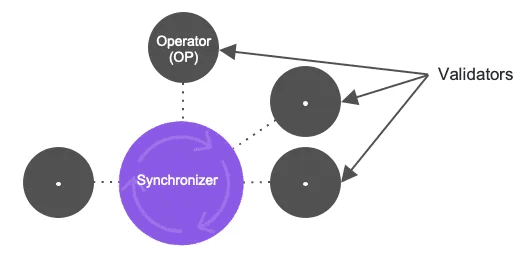

Within Canton, each application or group of participants can run its own sync domain. A sync domain acts as an ordering and timestamping service for that domain’s transactions. see Canton Network : A technical primer

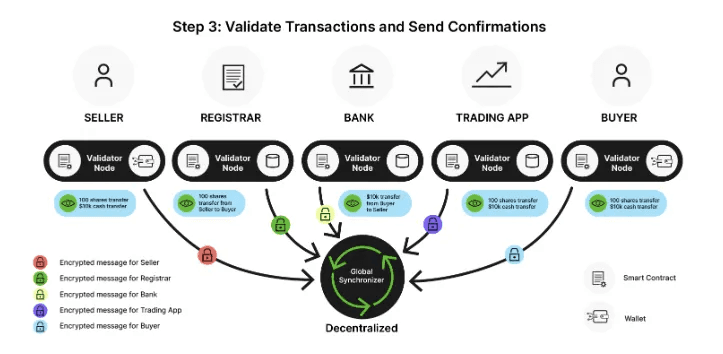

Meanwhile, Canton’s Global Synchronizer serves as a publicly-available synchroniser connecting applications and ensuring atomic settlement for cross-domain workflows.

This structure brings two major benefits: first, domains can operate independently, helping scalability and governance flexibility; second, when workflows span domains (for example, a tokenised asset swap from one domain to a payment domain), the Global Synchronizer ensures atomicity: the transaction either completes in all parts or in none.

Privacy, Visibility & Multi-Party Ledger Model

A standout feature of Canton is how it handles visibility and disclosure. Traditional public chains replicate the full ledger to every node, but Canton’s model means each participant maintains only the subset of the ledger they are authorised to see (“active contract set”).

At the sub-transaction level, parties only receive the view they need: in a delivery-versus-payment trade, the buyer sees the asset movement, the payment-leg party sees the cash transfer, but neither sees everything.

How canton achieve institutionnal grade privacy : canton.network

https://www.canton.network/blog/how-canton-network-delivers-institutional-grade-privacy.com

This selective disclosure design is native: it’s built into the architecture, not layered on as a “privacy bolt-on”. The privacy model supports regulatory auditability (you can disclose to regulators) while keeping competition-sensitive data private.

Composability, Real-Time Workflows & Tokenisation

Because each domain interoperates and supports atomic cross-domain workflow, Canton enables more sophisticated use-cases than simple token transfers. Workflow logic can span domains, maintain composability, and reflect business processes (rather than just transfers). This is enabled by the underlying smart-contract engine (built on the Daml language) and the Canton’s ledger model.

By permitting domains to scale independently, the network’s architecture avoids the single-chain bottleneck found in many blockchains: congestion or one popular application won’t inherently degrade the performance of other domains.

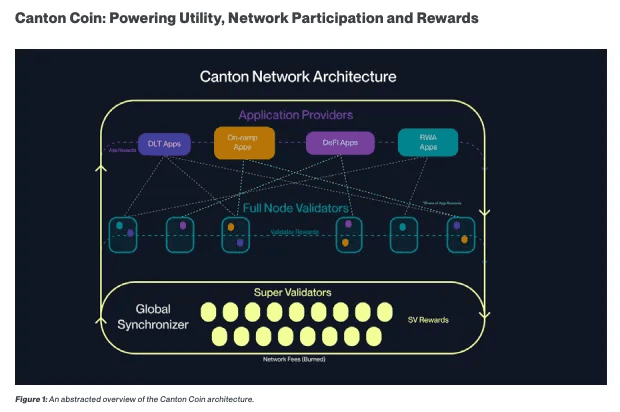

Token-Economics and Incentive Model

Central to the network’s economic design is the native token (Canton Coin). The model is usage-driven: network fees paid via the coin are burned, new coins are minted to infrastructure and application providers who add value. Supply is therefore tied to actual activity.

The Canton Network also introduces a native payment and utility token, Canton Coin , which underpins the economic layer of the ecosystem. Unlike many blockchain tokens distributed via pre-mines or early allocations, Canton Coin follows a fair-launch, utility-based model. Coins are minted by participants who deliver real value such as running infrastructure, providing liquidity, or deploying applications and are burned when used to pay network fees. This “burn-and-mint equilibrium” ensures that supply is tied to actual network usage rather than speculation.

Applications on Canton can denominate fees in fiat or other currencies but still settle payments in Canton Coin, giving participants flexibility while ensuring the network’s economic incentives remain aligned. Over time, as network usage grows, the value of Canton Coin reflects the genuine utility of the ecosystem rather than artificial scarcity.

What’s Being Built on Canton

The Canton Network is already supporting real-world use cases that showcase its unique strengths. One prominent example is its use in on-chain collateral and derivatives trading. Through its collaboration with QCP Capital, Canton enables 24/7 collateral management for bilateral crypto derivatives, combining on-chain transparency with institutional-grade confidentiality. This allows firms to post tokenised collateral and settle derivatives margins instantly, without exposing their strategies or counterparties to the public.

Beyond derivatives, Canton is being used to power applications for tokenised real-world assets including tokenised money-market funds, repo agreements, and stable-coin settlement systems. In its pilot programmes, the network has demonstrated how institutional participants can tokenize assets such as bonds or treasuries, use them as on-chain collateral, and move them seamlessly between financial applications. This unlocks significant capital efficiency, allowing assets to be used in multiple contexts without leaving the control of their owners.

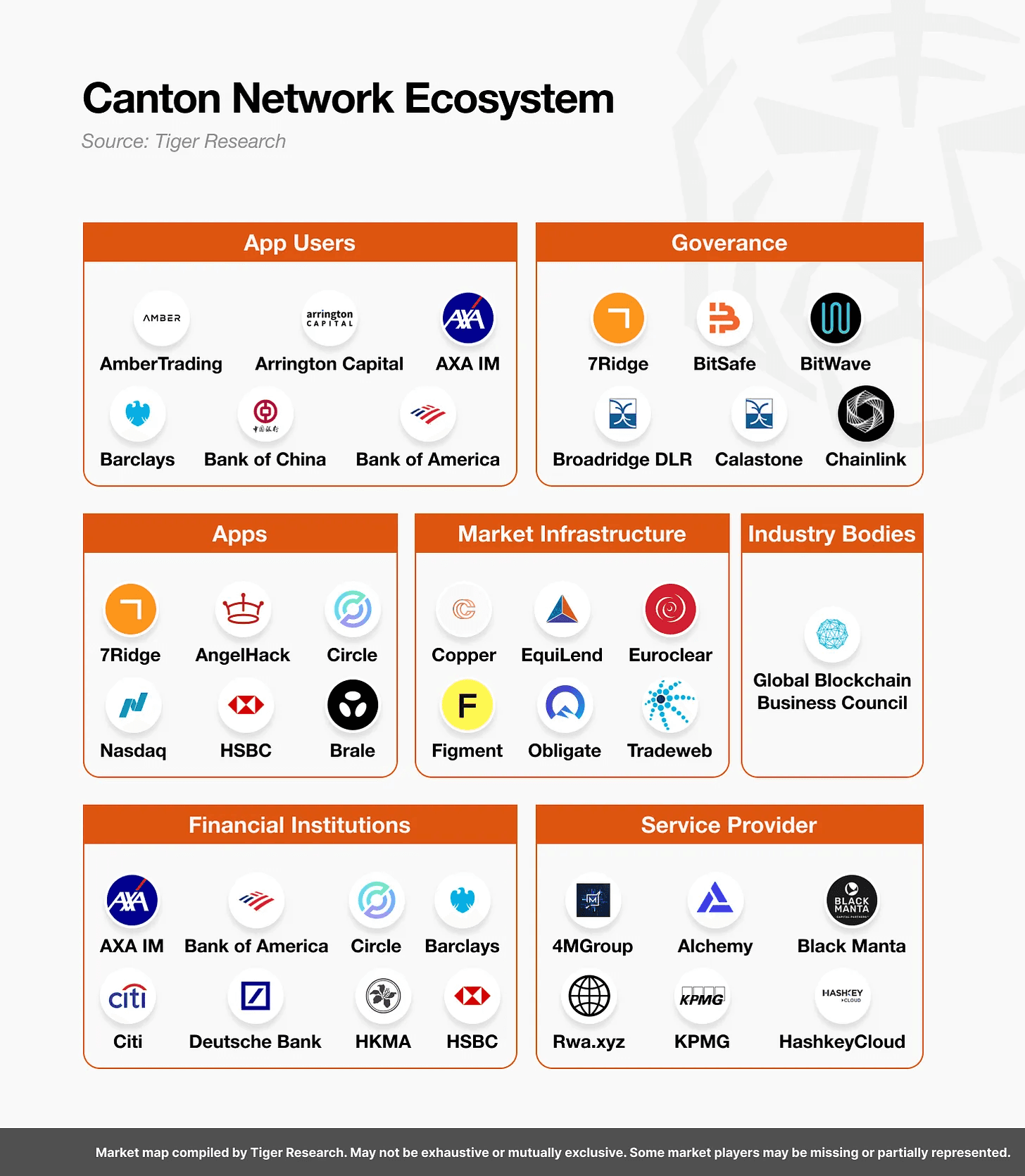

Reports from the Canton Network Pilot Program and recent ecosystem updates highlight over 45 major financial institutions and service providers exploring deployments on Canton infrastructure. This growing participation underscores its potential as the foundation layer for regulated digital-asset markets.

Source :

https://www.canton.network/blog/a-technical-primer?.com

https://www.canton.network/blog/on-chain-collateral-for-bilateral-crypto-derivatives-trading

https://23136104.fs1.hubspotusercontent-na1.net/hubfs/23136104/Canton_Report_2_5_v3.pdf

https://23136104.fs1.hubspotusercontent-na1.net/hubfs/23136104/Canton_Report_Part3of5_final.pdf

https://www.canton.network/hubfs/Canton%20Network%20Files/Images/Pilot%20Program/Canton%20Network%20Pilot%20Report-1548ed.pdf

Let's Talk

Join the community

Have a project in mind? Let’s get to work.We’re always open for a chat, so get in touch to findout how we can help.

© 2024 Enigma. All rights reserved.